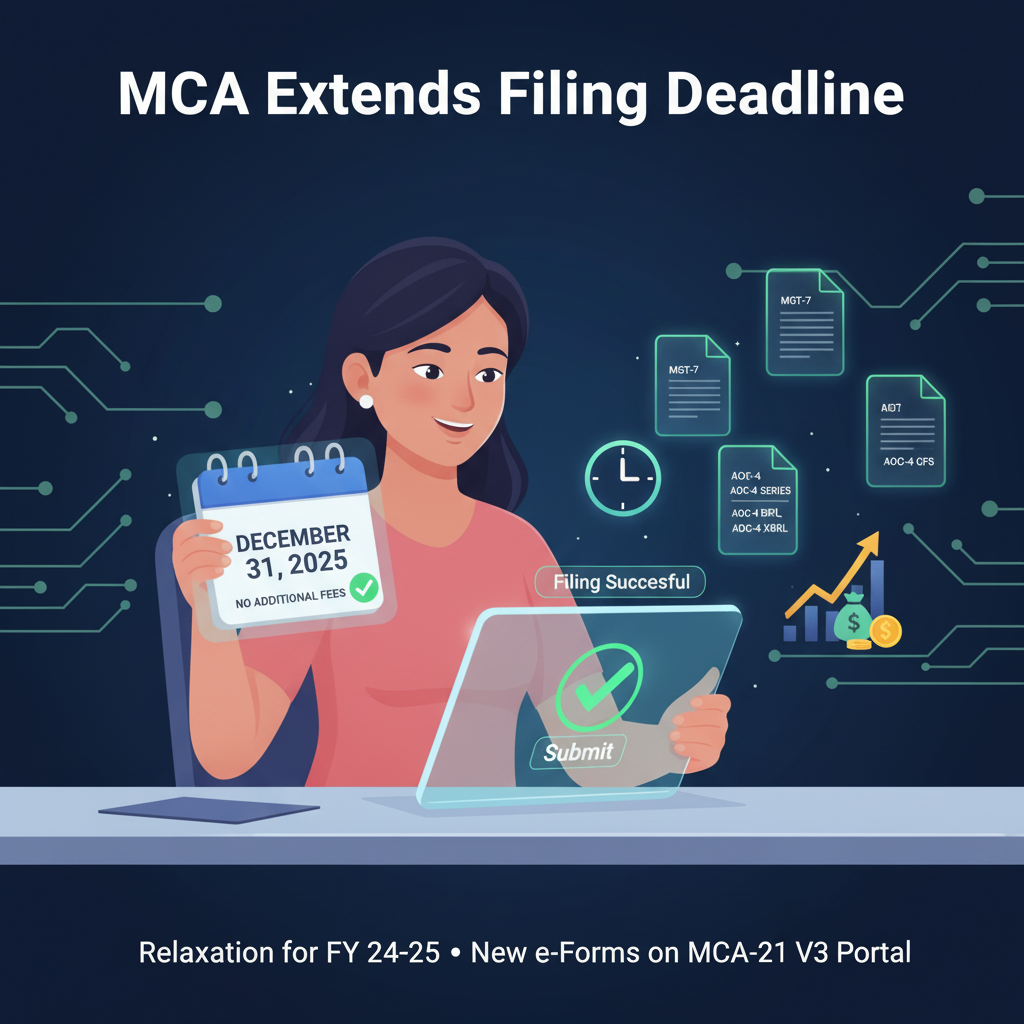

MCA Grants Relaxation for Annual Filings till 31st December 2025

The Ministry of Corporate Affairs (MCA) has issued General Circular No. 06/2025, dated 17th October 2025, providing a major relief to companies in India.

???? Key Update

MCA has waived additional filing fees for companies submitting their financial statements and annual returns for the financial year 2024–25 up to 31st December 2025.

This relaxation has been granted considering the recent deployment of revised e-Forms —

MGT-7, MGT-7A, AOC-4, AOC-4 CFS, AOC-4 NBFC (Ind AS), AOC-4 CFS NBFC (Ind AS), and AOC-4 (XBRL) — on the MCA-21 Version 3 portal.

Since companies may need additional time to adapt to the new filing system, MCA has temporarily eased the late-fee burden.

Important Clarification

It’s important to note that this relaxation does not extend the statutory due date for conducting Annual General Meetings (AGMs).

Companies failing to hold their AGM within the prescribed timelines under the Companies Act, 2013 will still be liable for legal action under applicable provisions.

Key Takeaways for Companies

- No additional fees for filings of FY 2024–25 made till 31st December 2025.

- Applicable to all companies required to file financial statements and annual returns.

- AGM deadlines remain unchanged.

- Late filings after 31st December 2025 will attract normal and additional fees as per the Companies (Registration Offices and Fees) Rules, 2014.

Conclusion

This move reflects MCA’s continued focus on ease of doing business and stakeholder convenience, especially amid the transition to the MCA V3 platform.

Companies should leverage this window to ensure timely and accurate filings while maintaining full compliance with AGM requirements.

Comments

No Comments yet